Giving Traders an EDGE

A general flaw of many traders is the habit of seeking “certainty” via indicators. It’s not uncommon to see charts with five to seven indicators overlaid on them. However, the traders that seek certainty through indicators are usually the same traders that don’t “dig deep” into the indicator to understand how it’s built.

Today we will “dig into” a very useful indicator that can generate significant reference points, which are useful for pinpointing entry levels, stop loss levels, and profit targets. But what if, in aggregate, traders were consistently on the wrong side of a trend? Now, that’s something worth using. And it is publicly available information that can help you become a more consistent trader. Enter pivot points…

Pivot Points: From Pit to Platform

A little known fact is that pivot points, contrary to other technical indicators, originated within trading pits of equity and futures exchanges. Perhaps this pragmatic origin is the reason why pivot points remain one of the most useful indicators out there. To properly understand pivot points, we need to explore how they are calculated. Take note that pivot points can be calculated for any time horizon. Traditionally, pivots were calculated based on daily data, but within FX this might not be the best (or only) way to employ them. But more on this later. For now, let’s start by understanding how daily pivot points are calculated.

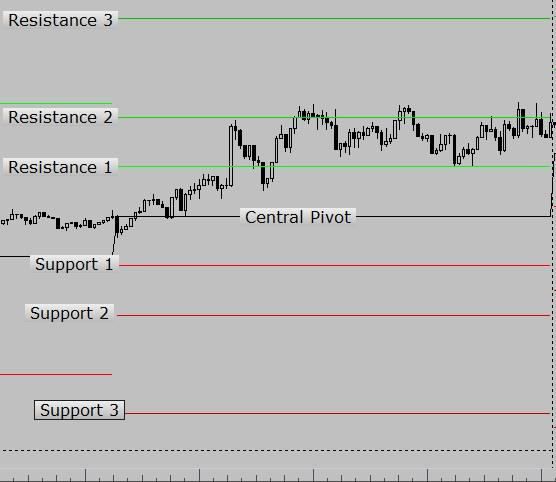

Central Pivot = (Previous Day High + Previous Day Low + Previous Day Close)/3

R1 = Central Pivot * 2 – Previous Day Low

S1 = Central Pivot * 2 – Previous Day High

R2 = Central Pivot – S1 + R1

S2 = Central Pivot – R1 – S1

R3 = Central Pivot – S2 + R2

S3 = Central Pivot – R2 – S2

Once these calculations are clear, we can explore the actual significance of the levels. If resistances and supports are actually significant (and not random), then we should find robust statistics to support this fact.

To do this, we have explored EURUSD daily data from Jan 1st 2014 to Jan 1st 2017. The calculations have demonstrated that the day’s low is:

- lower than S1 44% of the time

- lower than S2 18% of the time

- on average 2 pips below S1 (with a standard deviation of 51 pips)

- on average 49 pips above S2 (with a standard deviation of 69 pips)

while the day’s high is:

- higher than R1 43% of the time

- higher than R2 18% of the time

- on average 1 pip above R1 (with a standard deviation of 58 pips)

- on average 55 pips lower than R2 (with a standard deviation of 78 pips)

This means that more than 50% of the time, S1 and R1 are actually a good measure of the expected high and low for the day. This also means that more than 80% of the time, S2 and R2 are excellent projections for the actual high and low of the day!

Pivots can Help you Sell “High” and Buy “Low”

If there is one principle that most traders know but tend to neglect, it’s “buy low and sell high”. However, the concepts of “high” and “low” are relative and not absolute. With pivot points—along with their statistical edge—we can define high and low in a very robust way. You know that the odds are in your favour if you are a buyer at S1. If price rallies all the way past the central pivot and reaches R1, you might want to take some risk off the table, because R1 is, more often than not, the high for the day.

The same rationale goes for S2 and R2. If price exceeds S1 and reaches S2, the odds are even more tilted in your favour. Buying at S2 with a target at R1 is another solid way to exploit the statistical edge within pivots.

An even better idea is to use the pivot points within a solid trending phase, buying as price “dips” from R1 or R2 towards the central pivot or to S1 or S2. Vice-versa, traders can sell as price “rallies” from S1 or S2 towards the central pivot or R1 or R2.

Adapting Pivots to the FX Market Structure

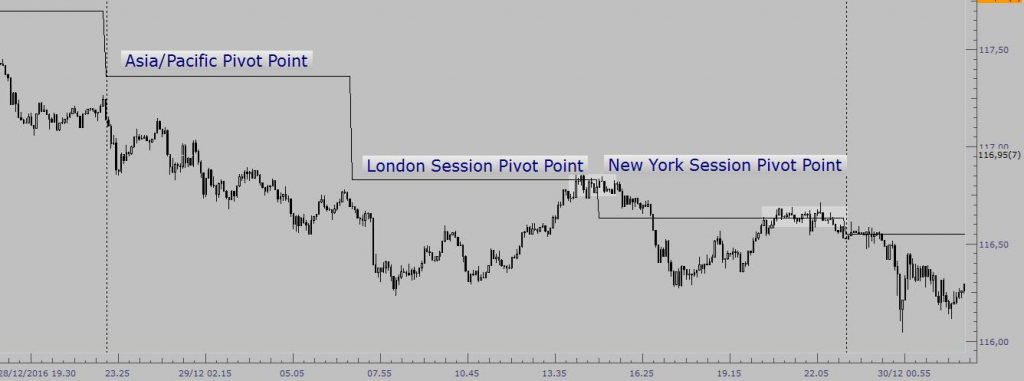

One key difference in FX that throws some people off-balance is that there isn’t a centralized market open and close. In reality, there are three main money centres that operate sequentially during a 24-hour period.

What this means is that there are actually three “market opens and closes”.

- The Asia/Pacific session: The majority of turnover in this timezone is done in Sydney, Tokyo, Hong Kong, and Singapore. Typically, there will be exporters and regional central banks active in this session. However, the liquidity is nowhere near as deep as it is during London or New York, and as such, the price action is not usually as interesting as it is during the other sessions. The Asia session does have its moments though: when there is regional data (Aud or Nz unemployment, Jpn Tankan, Central Bank meetings), you can bet on strong directional moves. But most of the time, this session is range-bound and consolidates whatever New York did.

- The London session: This is still the most important session of the day, for geographical reasons above all else. Along with London, other European financial centres are active—Frankfurt, Geneva, and Paris—and that’s why large corporate flows or M&A activity takes place during this session and contributes to the deep liquidity that London benefits from.

- The New York session: The Forex market experiences its peak in turnover as London passes the baton onto New York. However, whereas the London session tends to be a trendy session, New York has much more volatility and chop, so the trading strategies to deploy change significantly. Furthermore, after 12pm in New York, liquidity starts to dry up quickly.

It makes sense, in this context, to verify whether a “session-pivot” is just as useful for the session as the daily pivots are for the day. For this exercise, we have drilled down to 8-hour candles:

- from 23.00 to 7AM CET/SAST (Asia/Pac session proxy)

- from 7AM to 15.00 CET/SAST (London session proxy)

- from 15.00 to 23.00 CET/SAST (NY session proxy)

In order to explore the actual significance of the levels, we have explored EurUsd 8-hour data from Jan 1st 2016 to Jan 1st 2017.

The calculations have demonstrated that the session’s low is:

- lower than S1 42% of the time

- lower than S2 20% of the time

- lower than S3 7% of the time

- on average 0 pips below S1 (with a standard deviation of 35 pips)

- on average 28 pips above S2 (with a standard deviation of 47 pips)

while the day’s high is:

- higher than R1 44% of the time

- higher than R2 22% of the time

- higher than R3 6% of the time

- on average 1 pip above R1 (with a standard deviation of 35 pips)

- on average 28 pips lower than R2 (with a standard deviation of 48 pips)

This session data demonstrates how the market is fractal in nature: session and day statistics (but also week and month statistics) are almost carbon copies of each other! So, more than 50% of the time, S1 and R1 are actually a good measure of the expected high and low for the session. This also means that more than 80% of the time, S2 and R2 are excellent projections for the actual high and low of the session!

Once again, it’s best not to expect price to play “ping-pong” from the supports and resistances all day long. The savviest way to use this information is to collocate it in a trending market.

One way for intraday players to use this information in an organised way might be simply to look “long” when price is above both the daily and the session pivots, buying dips on retracements and taking profit around resistance levels.

Vice versa for shorts; intraday players can look “short” when price is below both the daily and the session pivots, selling rallies on retracements and taking profit around support levels.

Over to You

In this article, we have demonstrated how pivot points can be a versatile technical tool to help ascertain potential supports and resistances ahead of time, with statistical evidence to support it.

An intraday trader can use session data and daily data; a swing trader can potentially use daily data and weekly data; a position trader can use the weekly and monthly data in the same way because, as we have demonstrated, the market is fractal in nature. Traders can apply exactly the same logic on the smaller time frames as they do on the larger time frames. All that changes is the objectives for the trade.

If nothing else, pivot points allow you to walk into any given session—day, week, or month—ready and prepared to react to the market’s movements. And being prepared will already put you in an advantageous position.

Use Pivot Points in your trading with OmniTrader.